Repayment Options

There are several loan repayment options available to help medical students tackle the problem of student debt. Every student’s debt situation and overall financial health is unique, so advice on repayment strategies for one student may not necessarily apply to another. This is why it’s important to stay on top of your own loan portfolio, overall debt, and personal budget.

We highly recommend using the MedLoans Organizer and Calculator (MLOC), an online tool that allows users to import personal loan information and calculate expected monthly payments, total cost over the lifetime of the loan, and more. Another similar online tool is the Federal Student Aid Repayment Estimator. In addition, both the U.S. Department of Education and the AAMC have useful, up-to-date information on their websites regarding a variety of loan repayment plans.

As you evaluate the different repayment plan options, you should select a plan that allows for a manageable payment amount while keeping in mind that lower payments aren’t always better. The longer it takes you to repay your loan, the more interest you may pay overall. You should evaluate your financial needs and goals and try to find a repayment plan that offers a good balance.

Loan Repayment Options

Standard Repayment

- This will be your default plan if no other plan is chosen

- Fixed monthly payment with possibly the lowest interest-cost plan

- 10-year repayment term (longer if consolidated)

Extended Repayment

- Reduced payments stretched over a longer term (without consolidating)

- 25-year repayment term

- To be eligible, you must owe more than $30,000

- May ultimately be more costly because the lengthened term may increase the total interest paid

Graduated Repayment

- Initially smaller payments that increase after two years

- 10-year repayment term (longer if consolidated)

- May result in higher costs than the Standard Plan

Income-Contingent Repayment (ICR)

- Lower monthly payments with capitalization limited to 10% of the original amount owed (when you enter repayment)

- Payments are based on the lesser of either 20% of your monthly discretionary income or a 12-year payment plan times a percentage factor (which is based on income)

- Up to 25-year term, at which point the remaining balance is forgiven

- Need to reapply each year

Income-Based Repayment (IBR)

- Lower monthly payment based on family size and Adjusted Gross Income (AGI)

- Payment “caps” at 10% of your discretionary income

- Up to 20-year term, at which point the remaining balance is forgiven (but taxable)

- Partial Financial Hardship (PFH) needed to qualify

- Income and family size verification required annually

- Note: The terms are slightly different for those who are not new borrowers on or after July 1, 2014. See details at the AAMC website for more information.

Pay As You Earn Repayment (PAYE)

- Possibly one of the lowest monthly payments

- Capitalized interest cannot exceed 10% of the original amount owed (when you enter repayment)

- Payment “caps” at 10% of your discretionary income (based on family size and AGI)

- Up to 20-year term, at which point the remaining balance is forgiven (but taxable)

- Partial Financial hardship (PFH) needed to qualify

- Must be a new borrower on or after October 1, 2007 and have a Direct Loan disbursement on or after October 1, 2011

Revised Pay As You Earn Repayment (REPAYE)

- Possibly one of the lowest monthly payments during residency

- When your monthly payment doesn’t cover interest, you are only responsible for 50% of the interest

- Monthly payment is always based on your AGI and family size

- Up to 25-year term, at which point the remaining balance is forgiven (but taxable)

- No income requirements

Helpful Tools and Resources for Evaluating Your Options

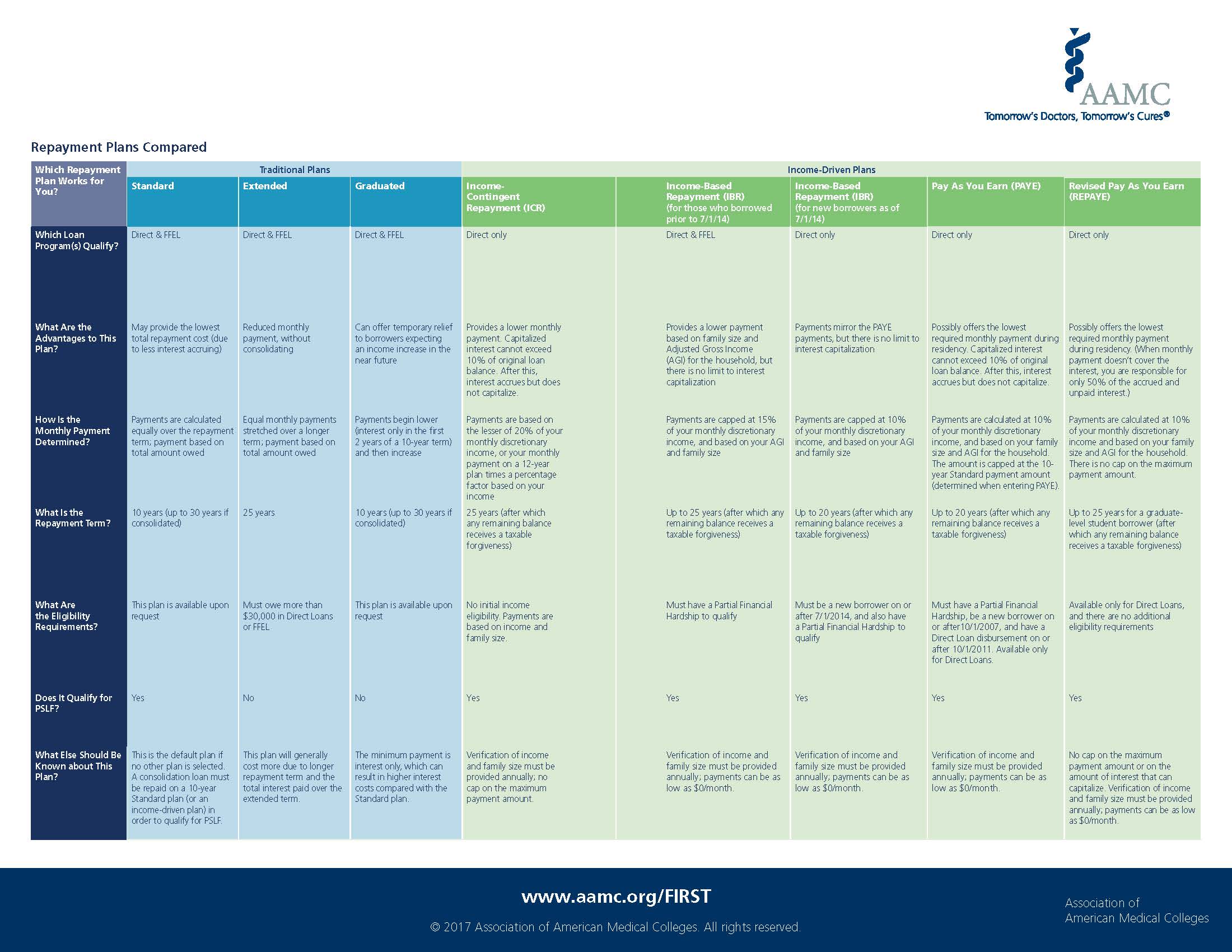

- AAMC Repayment Plans Compared chart (shown above)

- MedLoans Organizer and Calculator

- Federal Student Aid Repayment Estimator

- U.S. Department of Education’s Overview of Repayment Options

- AAMC Education Debt Manager Guide for Graduating Medical Students

- AAMC Loan Repayment/Forgiveness and Scholarship Program Database

- AAMC Monthly Payment Estimator for Medical School Borrowers

- AAMC worksheet on managing student loan payments with a resident salary

- AAMC article about preparing for repayment and preventing default

- AAMC Budgeting Worksheet for Residents

Ready to learn more? Check out these additional pages for more information about repayment and financial planning: